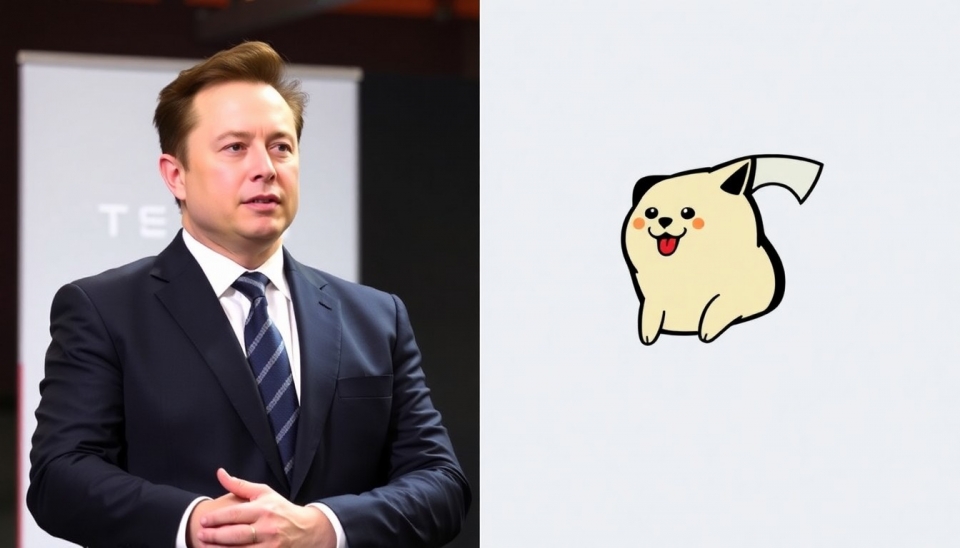

The ongoing connection between Elon Musk and Dogecoin has raised alarms among shareholders, particularly as voiced by the New York City Comptroller, Brad Lander. In recent statements, Lander expressed concerns that Musk’s engagement with the popular meme-based cryptocurrency is detrimental to Tesla and its investors. His critique centers around the idea that Musk's distractions with Dogecoin and its various promotions divert focus from Tesla's core business, potentially affecting financial performance.

Lander, who oversees a substantial pension fund investment in Tesla on behalf of New York City's employees, highlighted the negative implications this has for shareholders. He urged the Tesla board to reconsider Musk's role in promoting Dogecoin, which could be perceived as undermining the credibility and stability of a company that has significantly influenced the automotive industry and beyond.

As a figure often in the public eye for his prolific use of social media, particularly Twitter, Musk has frequently tweeted about Dogecoin, leading to volatility in its market value. Lander pointed out that while Musk is known for leveraging his influence to benefit various cryptocurrencies, it risks the reputations and fortunes of the companies he leads, including Tesla.

The NYC Comptroller suggested that such antics could be interpreted as irresponsible behavior from a CEO. This is particularly concerning as Tesla's stock has had fluctuating performances, and any negative perception related to Musk's antics could lead to financial repercussions for investors. Lander emphasized the need for Tesla’s management to prioritize the company and its investors over personal interests in the cryptocurrency market.

These revelations come against the backdrop of a broader scrutiny on how company leaders engage with cryptocurrencies, particularly as regulations around digital assets continue to evolve. Musk's unabashed promotion of Dogecoin raises fundamental questions about the responsibilities of CEOs regarding their company interests versus their personal investments and endorsements.

As shareholder propensity for accountability increases, calls for clarity on the intersection of Tesla's operations and Musk’s crypto ventures are likely to grow. Investors are expressing discomfort at the thought that one man's fascination with a meme cryptocurrency could impede the potential growth and sustainability of a pioneering automotive and technology firm.

The NYC Comptroller's remarks reflect a mounting concern among institutional investors about the influence of CEOs in the cryptocurrency realm, presenting a scenario where the lines between personal interests and corporate accountability have become increasingly blurred.

#ElonMusk #Dogecoin #Tesla #NYCComptroller #ShareholderAccountability #Cryptocurrency #Investors

Author: Liam Carter