In a bold move that exemplifies its unwavering belief in the potential of cryptocurrency, MicroStrategy has made headlines once again by purchasing an additional $5.4 billion worth of Bitcoin. This acquisition reinforces the company’s position as one of the largest institutional holders of the digital asset and further solidifies its strategy of converting cash reserves into crypto investments.

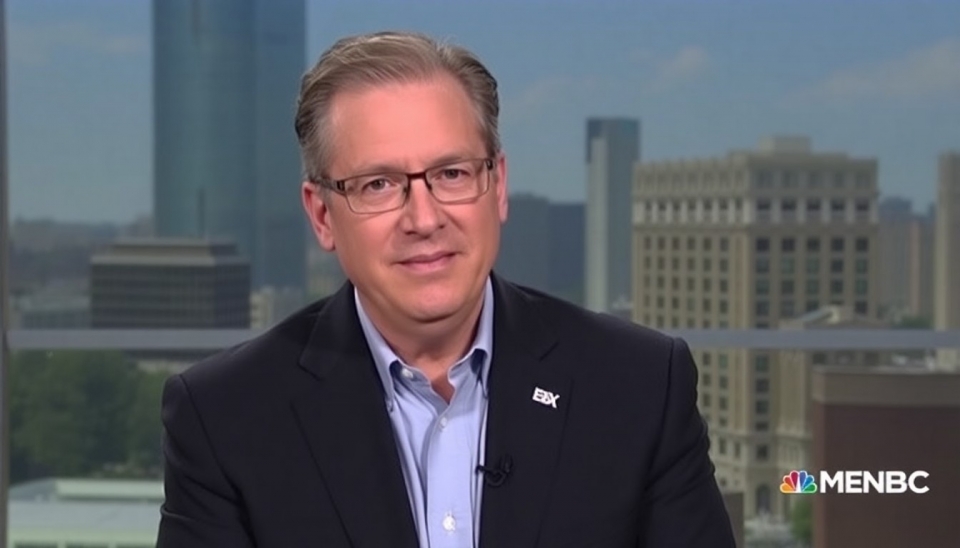

MicroStrategy, led by its outspoken CEO Michael Saylor, purchased the Bitcoin at an average price of approximately $31,800. This latest investment comes on the heels of previous acquisitions which have collectively allowed the company to build a substantial portfolio of Bitcoin. The decision to continue buying at this level indicates a strong conviction in the long-term value of Bitcoin, despite the volatile nature of cryptocurrency markets.

Michael Saylor has been an ardent advocate for Bitcoin, frequently emphasizing its potential as a hedge against inflation and a superior alternative to traditional currency. He argues that Bitcoin not only offers a way to preserve value but also positions MicroStrategy strategically for future growth in an increasingly digital financial landscape.

Since the inception of its Bitcoin acquisition strategy in 2020, MicroStrategy has purchased a total of approximately 16,000 BTC, resulting in a total expenditure nearing $8 billion. The recent purchase is expected to significantly influence MicroStrategy’s balance sheet, potentially attracting further attention from investors who view Bitcoin as a critical component of a diversified investment portfolio.

The cryptocurrency market has been on an upward trajectory lately, with Bitcoin reaching prices not seen for several months. This bullish trend can be linked to various factors, including increased institutional adoption, a growing interest in decentralized finance (DeFi), and the reduction in Bitcoin supply due to periodic halving events. MicroStrategy’s aggressive accumulation strategy may be contributing to the burgeoning confidence in Bitcoin as institutional investors look to explore the benefits of owning digital assets.

Analysts suggest that MicroStrategy's continuous investment signals a confidence in Bitcoin that could ripple through the financial ecosystem, prompting more companies to consider similar investments. As cryptocurrency continues to gain traction among mainstream financial institutions, MicroStrategy’s actions might serve as a catalyst for a broader acceptance of Bitcoin as a legitimate asset class.

In summary, MicroStrategy’s latest $5.4 billion Bitcoin purchase is a clear indication of its commitment to maintaining a significant presence in the cryptocurrency space. As the company navigates the evolving market, its investments are likely to attract more attention and discussion regarding the viability of Bitcoin as a long-term investment vehicle.

Expect further developments from MicroStrategy as it continues to be a pivotal player in the ever-evolving world of cryptocurrency.

#MicroStrategy #Bitcoin #CryptoInvestment #MichaelSaylor #DigitalAssets #InstitutionalInvesting #BTC #Cryptocurrency #FinancialInnovation

Author: John Miller