In a strategic move ahead of its anticipated inclusion in the prestigious Nasdaq 100 index, MicroStrategy has announced another significant acquisition of Bitcoin. The business intelligence firm, which has made waves in the cryptocurrency space, continues to bolster its digital asset portfolio, solidifying its position as one of the largest publicly traded holders of Bitcoin.

The latest purchase, which adds thousands of bitcoins to MicroStrategy’s existing stash, comes as the company prepares for the news of its inclusion in the Nasdaq 100 index. This milestone is noteworthy, not only for the company but also for the broader cryptocurrency ecosystem, as it signals mainstream acceptance and recognition of digital assets through established financial channels.

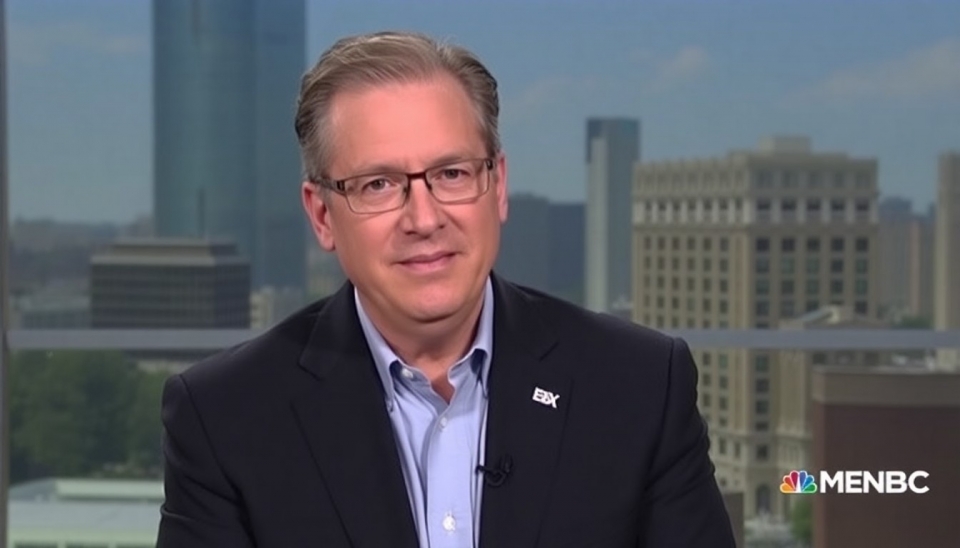

MicroStrategy, led by its CEO Michael Saylor, has been an avid proponent of Bitcoin since the firm made its first foray into the market in 2020. The company's strategy revolves around accumulating Bitcoin as a primary reserve asset, diving deep into the philosophy that Bitcoin will serve as a hedge against inflation and currency devaluation. This accumulation strategy has proven fruitful as Bitcoin's value soared over the years, providing significant returns on investment.

As MicroStrategy prepares for its integration into the Nasdaq 100, the firm's latest Bitcoin acquisition is seen by analysts as both a bullish move for the company and a potential catalyst for further institutional interest in cryptocurrency as an asset class. The Nasdaq 100, which comprises 100 of the largest non-financial companies listed on the Nasdaq stock market, features high-profile firms such as Apple, Microsoft, and Amazon. The addition of a Bitcoin-focused entity underscores the shifting dynamics in the financial markets towards digital currencies.

The implications of MicroStrategy’s inclusion in this elite index are manifold. For one, it may pave the way for greater acceptance of Bitcoin by traditional investors, who typically remain within the confines of conventional assets. Moreover, this move could also enhance MicroStrategy's market visibility, encouraging other corporations to reconsider their own investment strategies in relation to cryptocurrencies.

As the cryptocurrency market continues to evolve, all eyes are on MicroStrategy to determine the extent to which its actions influence other publicly traded companies' approaches to digital assets. The company's steadfast commitment to Bitcoin could very well set a precedent, shaping the future of investments in cryptocurrencies amid traditional market environments.

In summary, MicroStrategy's recent Bitcoin acquisition not only fortifies its position as a market leader in digital assets but also signals a broader trend of institutional integration of cryptocurrencies, highlighted by its imminent entry into the Nasdaq 100. This juxtaposition of technology and finance might resonate throughout the industry, inspiring a wave of acceptance and innovation in the coming years.

As events unfold, stakeholders and enthusiasts alike will be keenly watching MicroStrategy’s next moves and their influence on the ever-dynamic landscape of cryptocurrency investments.

#MicroStrategy #Bitcoin #Nasdaq100 #Cryptocurrency #Investment #Blockchain #MichaelSaylor

Author: John Miller