In a remarkable development within the financial realm, Huawei Technologies Co. has raised an astounding $2.7 billion in a recent debt issuance event, marking a significant milestone for the company amidst ongoing technological and geopolitical challenges. This funding initiative, which is being hailed as one of the largest in Chinese corporate history, has attracted substantial attention from investors, reflecting sustained confidence in Huawei's long-term strategies and its crucial role in the global tech ecosystem.

According to reports, the telecommunications giant executed this debt issuance over a span of two days, successfully capturing the interest of both domestic and international investors. The bonds, which have been touted as a vital lifeline for Huawei, are intended to bolster the company’s liquidity, support its development in 5G technology, and sustain operations as it navigates through the complexities of international market dynamics.

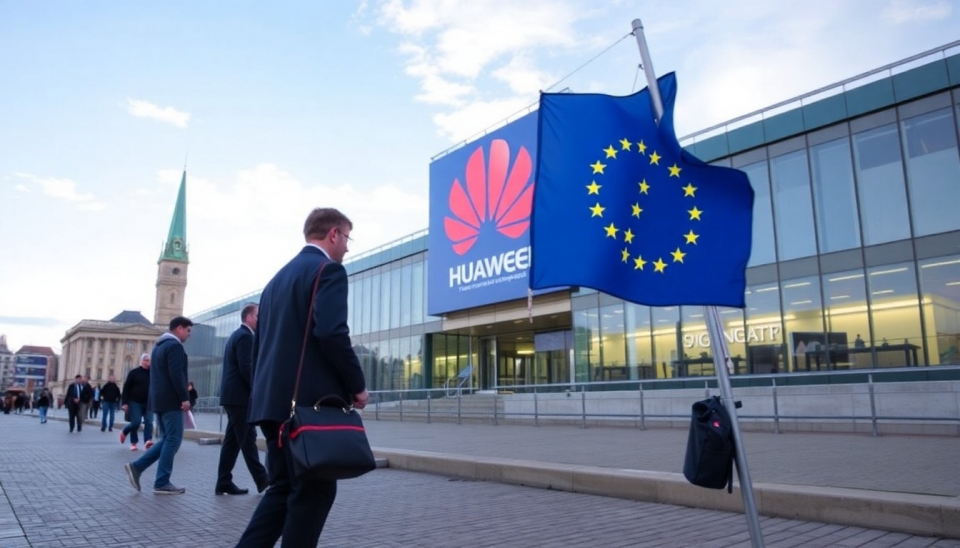

Huawei’s foray into the bond market comes at a time when the tech industry is grappling with an environment rife with uncertainty due to regulatory pressures and evolving trade policies. The company faced intense scrutiny and restrictions from several countries, notably the United States, which has hindered its ability to procure necessary components and materials. Despite these challenges, Huawei has remained resilient, continuing to innovate and expand its business offerings across multiple sectors, including telecommunications infrastructure and consumer electronics.

The terms of the debt issuance indicate robust interest, with the total oversubscription implying a strong demand for Huawei’s bonds. This issuance is seen as a strategic maneuver to strengthen its financial position, allowing the firm to invest in critical research and development initiatives that are key to maintaining its competitive edge in the global market.

Market analysts are optimistic about this move, suggesting that the successful debt issuance could serve as a barometer for investor sentiment towards other Chinese tech companies facing similar predicaments. A successful debt issuance such as this not only provides immediate capital but also sends a strong signal to the market about the resilience and future potential of the tech sector, which has been a focal point of economic growth in China.

In light of this significant move, Huawei’s management has indicated that the proceeds from the bond issuance will be strategically allocated to bolster its existing operations, enhance supply chain stability, and continue investing in innovation, particularly in next-generation technologies like artificial intelligence and semiconductor manufacturing. This signals a proactive approach to overcoming existing hurdles and positions Huawei well for future growth trajectories as the technological landscape continues to evolve.

As Huawei ventures into this new chapter of financial fortification, industry observers will be keenly watching how this injection of capital will influence its operational dynamics and whether it can leverage this opportunity to regain some of its lost market share. By strengthening its financial foundation, Huawei aims to enhance its ability to navigate through the complexities of international trade and technology transfers, setting the stage for a potentially transformative period ahead.

The ramifications of this debt issuance extend beyond Huawei itself, potentially establishing new benchmarks for financing within the Chinese tech industry and influencing investor strategies in the sector. As the landscape becomes increasingly competitive, the ability to secure such funding will be crucial for sustaining growth and innovation.

#Huawei #DebtIssuance #Investment #ChinaTech #Telecommunications #5G #GlobalMarket #FinancialResilience #InvestorSentiment #TechIndustry

Author: Emily Collins