Trump to Host Exclusive Dinner with Top Holders of His Pioneering Memecoin

In a groundbreaking move, former President Donald Trump is set to host an exclusive dinner with key investors and top holders of his recently launched memecoin, known as "TrumpCoin." This event is seen as a significant step in merging politics and cryptocurrency, offering a unique platform for discussions about the future of digital currencies and their impact on the economy.

Continue reading

Japan's Financial Authority Reports $700 Million Loss from Online Trading Hacks

In a shocking revelation, the Financial Services Agency (FSA) of Japan has reported that online trading platforms have suffered significant security breaches, resulting in losses amounting to approximately $700 million. This alarming incident raises serious concerns about the safety measures employed by brokerage firms and the potential repercussions for investors within the rapidly evolving digital trading landscape.

Continue reading

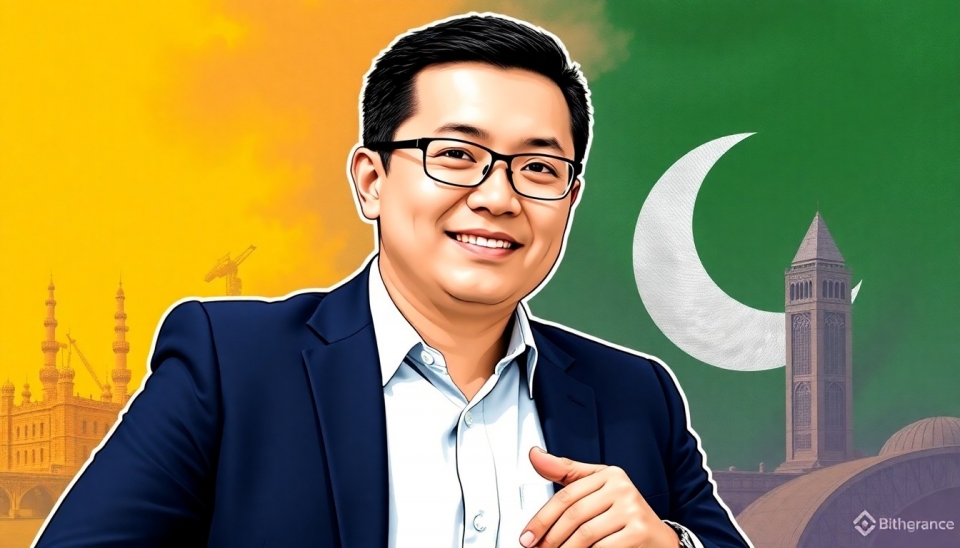

Binance Founder Zhao Partners with Pakistan for Crypto Expansion

The world of cryptocurrency is witnessing a significant development as Changpeng Zhao, the CEO of Binance, has announced his collaboration with the Pakistani government to enhance the cryptocurrency trading landscape in the country. This initiative, which aims to boost digital finance and integrate Pakistan into the global cryptocurrency marketplace, comes amid Pakistan's growing interest in decentralized finance and blockchain technology.

Continue reading

Elon Musk Appeals to Supreme Court for Coinbase Users' Protection from IRS Investigation

In a groundbreaking legal maneuver, Elon Musk has asked the U.S. Supreme Court to intervene in an ongoing investigation by the Internal Revenue Service (IRS) that targets users of the cryptocurrency exchange Coinbase. This move signifies Musk's heightened interest in protecting individual rights in the rapidly evolving landscape of cryptocurrency regulation.

Continue reading

Liberty Enters the Cryptocurrency Arena: Trump's Influence Expands to Digital Finance

In a surprising turn of events within the cryptocurrency landscape, former President Donald Trump is set to make a significant mark as his company, Liberty, launches a new venture into the fast-paced world of digital finance. This development is part of a wider trend where traditional figures are venturing into the burgeoning crypto sphere, which has gained immense popularity and utility over the recent years.

Continue reading

Trump's Cryptocurrency Venture to Launch Dollar-Linked Stablecoin

In a significant development within the cryptocurrency landscape, former President Donald Trump is venturing into the digital finance space with plans to launch a stablecoin designed to track the value of the U.S. dollar. This announcement comes at a time when cryptocurrencies are gaining traction, with increasing interest from both investors and regulators.

Continue reading

Mobile Money Platform Mukuru Sets Ambitious Plans for African Expansion

In a bold move to strengthen its foothold in the rapidly growing financial technology sector across Africa, Mukuru, a prominent mobile money service provider, has outlined its strategies for regional expansion. This comes amid increasing competition and the evolving landscape of digital finance on the continent. Mukuru aims to enhance accessibility to financial services for the underserved populations in various African nations.

Continue reading

Major Tech Advances and Industry Shifts Highlighted in Bloomberg Technology Update

In a recent episode of Bloomberg Technology aired on March 20, 2025, viewers were presented with a comprehensive overview of significant advancements within the tech industry, as well as critical shifts in market dynamics. This episode brought together leading experts, industry analysts, and thought leaders who shared their insights on the evolving landscape of technology, particularly in the realms of artificial intelligence, cybersecurity, and digital finance.

Continue reading

GCash Eyes 10-15% Public Float in Upcoming IPO to Expand Financial Services

The Philippine fintech giant GCash has announced plans to pursue an initial public offering (IPO) that aims for a public float of 10 to 15 percent. This strategic move comes as the company seeks to capitalize on its rapid growth and further solidify its position in the Southeast Asian financial services market.

Continue reading

Mexican Fintech Startup Plata Achieves Unicorn Status in $160 Million Funding Round

In a significant development for the Latin American fintech landscape, Plata, a prominent fintech company based in Mexico, has announced that it has achieved unicorn status following a robust funding round that raised $160 million. The investment was spearheaded by Kora, a venture capital firm known for its strategic investments in high-growth companies.

Continue reading