MicroStrategy Inc., known for its aggressive investment strategy in Bitcoin, is drawing attention and raising questions about its potential inclusion in the NASDAQ 100 index. The company is at the forefront of a trend where corporate balance sheets increasingly reflect cryptocurrency holdings, and its recent moves have intensified discussions around the criteria for index membership.

Founded in 1989, MicroStrategy has transitioned from being a software business to a leading institutional investor in Bitcoin. The firm, led by CEO Michael Saylor, has accumulated more than 158,000 Bitcoins since adopting a strategy focused heavily on cryptocurrencies in 2020. This substantial investment has brought both scrutiny and admiration, particularly due to the volatility associated with crypto assets.

The NASDAQ 100 is composed of the 100 largest non-financial companies listed on the NASDAQ stock market. Inclusion in this index represents a significant milestone for any company, often leading to increased visibility and investment interest. However, there are stringent criteria that companies must meet to be considered for inclusion. This includes factors such as market capitalization, share liquidity, and the nature of the business and its revenue streams.

MicroStrategy's position as a tech company differentiates it from traditional Bitcoin companies, yet its core business operations are now closely tied to its cryptocurrency holdings. Critics argue that the firm's focus on Bitcoin raises fundamental questions about its revenue generation and overall business model. Others assert that if the inclusion of Bitcoin in corporate portfolios becomes normalized, MicroStrategy's odds at joining the NASDAQ 100 could improve.

The debate surrounding MicroStrategy’s potential NASDAQ 100 inclusion comes on the heels of other technology companies showing interest in cryptocurrencies and blockchain technology. As more firms explore digital assets, the lines separating pure technology companies from those adopting crypto strategies may begin to blur, which could necessitate a reevaluation of what constitutes a qualifying firm for the NASDAQ 100.

Market analysts are closely watching how MicroStrategy’s Bitcoin investments will impact its stock performance and whether it can bolster its financial position enough to meet the NASDAQ’s rigid index requirements. As cryptocurrency experiences dynamic shifts in value, the associated risk factors complicate matters for investors and index regulators alike.

Despite the challenges, MicroStrategy remains undeterred. The firm has indicated that it will continue to acquire more Bitcoin, suggesting a long-term faith in the digital currency's future prospects. Stakeholders and market watchers alike remain eager to see how this bold approach will unfold and what it might mean for traditional metrics of corporate success and index qualification.

As MicroStrategy navigates these waters, industry experts emphasize the importance of transparency and sustainability in its business practices. The changing financial landscape calls for continuous dialogue about the role of cryptocurrencies in corporate finance and their eventual influence on major stock market indices.

In conclusion, MicroStrategy’s audacious stance on Bitcoin is not just reshaping its image; it is challenging established norms within the financial markets. With ongoing speculation about its NASDAQ 100 eligibility, all eyes are on MicroStrategy as it potentially paves the way for a new era of digital asset involvement amongst traditional corporations.

#MicroStrategy #Bitcoin #NASDAQ100 #Cryptocurrency #Investing #TechStocks #FinancialMarkets

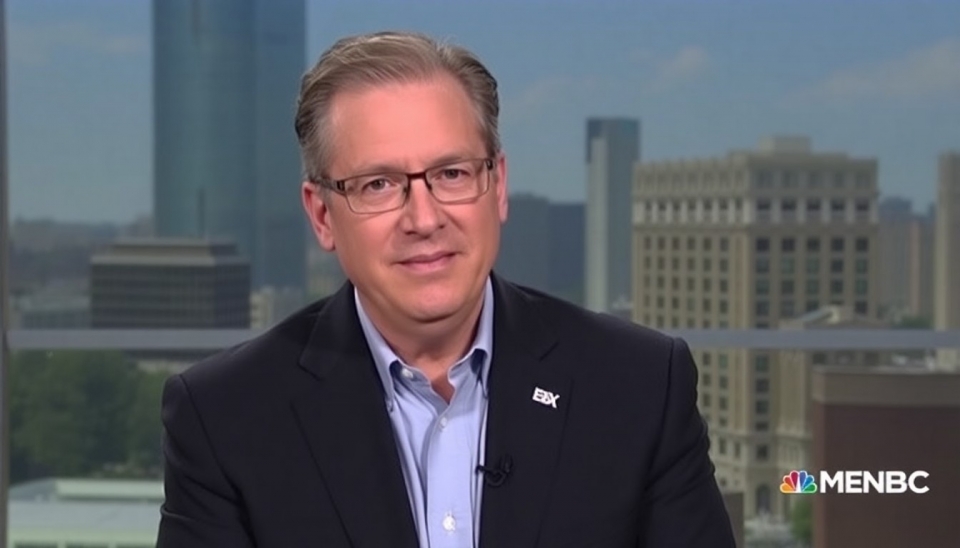

Author: Michael Turner